At a CAGR of 6.49%, the U.S. HVDC Converter Station Market is expected to reach USD 2.10 billion by 2033 from USD 1.28 billion in 2025E. Driven by modernization of transmission infrastructure, rising renewable energy integration, expansion of cross-border power projects, and adoption of advanced HVDC technologies that enhance grid reliability, stability, and overall efficiency.

Austin, Jan. 12, 2026 (GLOBE NEWSWIRE) — HVDC Converter Station Market Size & Growth Insights:

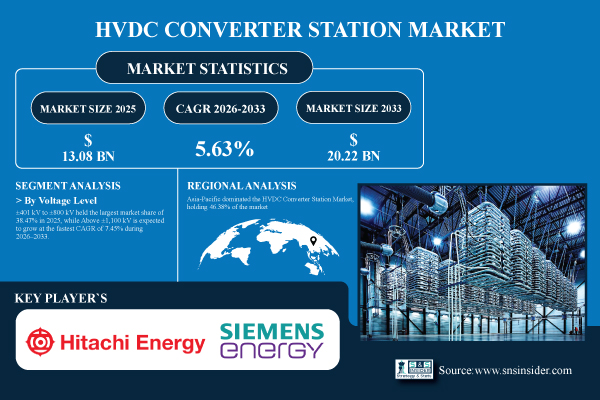

According to the SNS Insider, “The HVDC Converter Station Market Size is estimated at USD 13.08 Billion in 2025 and is projected to reach USD 20.22 Billion by 2033, growing at a CAGR of 5.63% during 2026–2033.”

Increasing Renewable Energy Integration and Long-distance Power Transmission to Augment Market Growth Globally

The demand for long-distance power transmission and the growing integration of renewable energy sources are the main factors propelling the growth of the HVDC Converter Station market. To effectively move electricity from renewable sources, such as wind, solar, and hydro to urban and industrial areas, governments and utilities are investing in cutting-edge, high-voltage transmission infrastructure. Technological developments in digital monitoring systems, smart grid integration, and converter stations are improving safety, efficiency, and dependability, which is speeding up market adoption and fostering long-term growth.

Get a Sample Report of HVDC Converter Station Market Forecast @ https://www.snsinsider.com/sample-request/9164

Leading Market Players with their Product Listed in this Report are:

- Hitachi Energy Ltd.

- Siemens Energy AG

- ABB Ltd.

- GE Grid Solutions LLC (General Electric)

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions Corporation

- NR Electric Co., Ltd.

- C-EPRI Electric Power Engineering Co., Ltd.

- Nexans S.A.

- Prysmian Group

- Schneider Electric SE

- Alstom Grid

- Bharat Heavy Electricals Limited (BHEL)

- Xian XD Power System Co., Ltd.

- LS Cable & System Ltd.

- Hyosung Heavy Industries

- China XD Group

- State Grid Corporation of China (SGCC)

- Nissin Electric Co., Ltd.

- Crompton Greaves Ltd.

HVDC Converter Station Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025E | USD 13.08 Billion |

| Market Size by 2033 | USD 20.22 Billion |

| CAGR | CAGR of 5.63 % From 2026 to 2033 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Voltage Level (±100 kV to ±400 kV, ±401 kV to ±800 kV, ±801 kV to ±1,100 kV, Above ±1,100 kV) • By Technology (Line-Commutated Converter, Voltage-Source Converter, Modular Multi-Level Converter) • By Application (Long-Distance Power Transmission, Renewable Energy Integration, Industrial Power Supply, Grid Interconnection, Offshore Transmission, Smart Grid) • By Component (Converter Transformers, Valves, Smoothing Reactors, AC & DC Filters, Cooling Systems, Control & Protection Systems, Switchgear & Breakers) • By Installation Type (New Installation, Retrofit/Upgrade/Modernization) • By End-Use (Utilities, Industrial, Commercial, Renewable Power Plants, Government & Defense) |

Purchase Single User PDF of HVDC Converter Station Market Report (20% Discount) @ https://www.snsinsider.com/checkout/9164

High Capital Investment, Complex Technology, and Lengthy Project Timelines are Hampering Market Growth

Significant barriers to the HVDC Converter Station Market include high capital expenditure, complicated technology, and protracted project schedules. Adoption in economically sensitive areas is constrained by the high upfront costs associated with developing converter stations, which include land, equipment, and skilled personnel. Complex technology, such as sophisticated converters and control systems, necessitates specific knowledge for design, installation, and upkeep. Commissioning may be delayed by lengthy project durations and regulatory approvals.

Key Segmentation Analysis

By Voltage Level

±401 kV to ±800 kV held the largest market share of 38.47% in 2025 due to its widespread use in long-distance bulk power transmission and cross-border grid interconnections. Above ±1,100 kV is expected to grow at the fastest CAGR of 7.45% during 2026–2033 driven by ultra-long-distance transmission needs. Supporting cross-country electricity transfer from remote renewable generation hubs.

By Technology

Line-Commutated Converters (LCC) accounted for the highest market share of 42.31% in 2025 owing to its reliability, high power-handling capacity and suitability for bulk electricity transmission. Modular Multi-Level Converters (MMC) are projected to expand at the fastest CAGR of 7.22% over the forecast period supported by offshore wind integration and urban grid applications.

By Application

Long-Distance Power Transmission dominated with a 36.88% share in 2025 as countries increasingly rely on HVDC systems to transport electricity efficiently over vast distances with minimal losses. Renewable Energy Integration is anticipated to record the fastest CAGR of 7.11% through 2026–2033 driven by large-scale wind and solar installations.

By Component

Converter Transformers held the largest share of 33.59% in 2025 due to their essential role in voltage conversion and system stability within HVDC converter stations. Control & Protection Systems are forecasted to register the fastest CAGR of 7.34% during the forecast period supported by digitalization and smart grid integration.

By Installation Type

New Installations accounted for the highest market share of 61.44% in 2025 as countries continue expanding transmission infrastructure to meet rising electricity demand and renewable integration goals. Retrofit / Upgrade projects are expected to grow at the fastest CAGR of 6.85% during 2026–2033 driven by aging infrastructure and technology modernization.

By End-Use

Utilities & Grid Operators dominated the market with a 48.93% share in 2025 as they are primary investors in national and regional transmission infrastructure. Renewable Power Plants are projected to expand at the fastest CAGR of 7.03% over the forecast period driven by offshore wind and large solar projects.

Regional Insights:

With 46.38% of the market, Asia Pacific dominated the HVDC Converter Station market. Large-scale HVDC projects in China, India, Japan, and Southeast Asia are driving the region’s growth through the expansion of power transmission networks and the growing integration of renewable energy.

The North America HVDC Converter Station Market is the fastest-growing region, projected to expand at a CAGR of 6.98% during the forecast period. Growth is driven by modernization of aging transmission infrastructure, increasing integration of renewable energy projects and cross-border electricity initiatives between the U.S. and Canada.

Do you have any specific queries or need any customized research on HVDC Converter Station Market? Schedule a Call with Our Analyst Team @ https://www.snsinsider.com/request-analyst/9164

Recent Developments:

- In April 2025, Hitachi Energy secured a contract to deliver a 950‑km HVDC transmission system transmitting 6 GW of renewable energy in India, enhancing grid capacity, clean energy integration and supporting sustainable power supply with advanced HVDC technology solutions.

- In April 2025, Siemens Energy was selected as the preferred bidder for the 2 GW Sea Link HVDC project across the North Sea, marking a strategic milestone in Europe’s high-voltage power transmission infrastructure and supporting large-scale renewable energy integration and grid modernization efforts.

Exclusive Sections of the HVDC Converter Station Market Report (The USPs):

- MARKET PERFORMANCE & REVENUE STRUCTURE METRICS – helps you evaluate global installed HVDC converter capacity by region, project cost trends per MW, and revenue contribution from new installations versus retrofits.

- ADOPTION & DEPLOYMENT EFFICIENCY INDICATORS – helps you assess HVDC adoption rates in long-distance transmission and renewable integration projects, commissioning timelines, utilization levels, and future project pipeline growth.

- SUPPLY CHAIN & COMPONENT RISK ANALYSIS – helps you identify lead times, supplier concentration for critical components, and logistics cost contribution impacting project execution and cost stability.

- TECHNOLOGY & INNOVATION ADOPTION RATE – helps you track penetration of advanced HVDC technologies such as VSC and MMC, R&D investment intensity, patent activity, and efficiency improvements.

- TRANSMISSION PERFORMANCE & GRID INTEGRATION METRICS – helps you measure transmission efficiency gains over AC systems, power quality enhancement, and integration with renewable power plants and smart grid infrastructure.

- REGULATORY, SAFETY & ENVIRONMENTAL COMPLIANCE METRICS – helps you gauge adherence to grid codes, safety incident frequency, environmental compliance, reliability performance, and end-of-life recycling standards.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaChron.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaChron.com takes no editorial responsibility for the same.